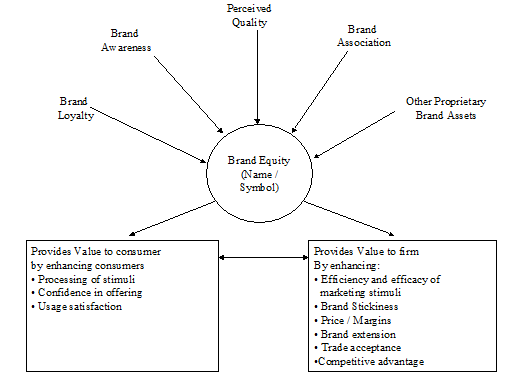

“Brand Equity is a set of brand assets and liabilities linked to a brand, its symbol, that adds to or subtracts from the value provided by a product or services to a firm and / or to that firms customers.” ( David Aaker, University of California)

“The added value to a firm, the trade, or the consumer with which a given brand endows a product”. (Peter Farquhar, Claremont Graduate School)

“The set of associations and behaviours on the part of the brand’s customers, channel members, and parent corporations that permits the brand to earn greater volume or greater margins than it could without the brand name and that gives the brand a strong, sustainable, and differentiated advantage over competitors. (Marketing Science Institute)

Brand equity refers to the marketing effects or outcomes that accrue to a product with its brand name compared with those that would accrue if the same product did not have the brand name. And, at the root of these marketing effects is consumers’ knowledge. In other words, consumers’ knowledge about a brand makes consumers respond differently to the marketing of the brand. The study of brand equity is increasingly popular as some marketing researchers have concluded that brands are one of the most valuable assets that a company has.

How Brand equity generates value

The definition of brand equity suggests that a brand has added value, beyond that which comes from the function performed by the product or service. This added value often manifests itself as an increase in one or more of the following:

- Market share,

- Price premium/margin,

- Customer loyalty,

- Trade access and cooperation,

- Effectiveness of marketing program (such as advertising),

- Brand extension opportunities,

- Resistance to competitive attacks on the brand.

While brand equity is a hot topic of contemporary marketing, and at first glance it seems to have intuitive appeal, given a second careful look it turns out to be a very ‘slippery’ concept.

Brand equity is a useful concept for marketing managers to the extent that it provides the stimulus and guidance to make better decisions about building brands of relevance and distinction. Although there is broad agreement about basic principles of Brand Equity, there are various models of brand equity with different perspective which helps us to understand the same better:

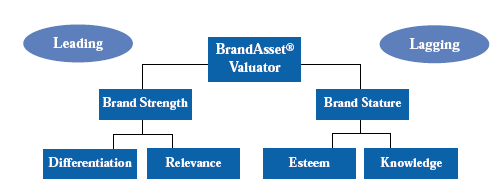

Young and Rubicam (Y&R). Brand Asset Valuator™ model

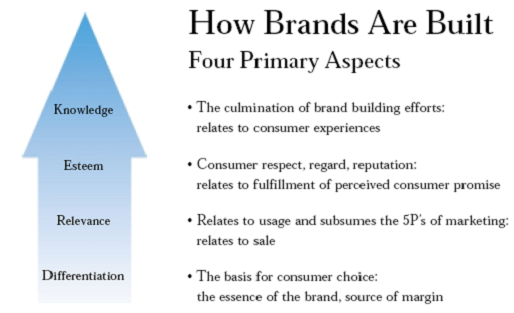

This is a model way of how to build a strong brand. This is based on work that was conducted with over 35,000 brands over 30 years, looking at what it is that differentiates brands that are successfully able to develop and maintain as a strong brand, versus those that are not. This work shows four ‘pillars’ of brand strength. As per Y&R Brand PowerGrid successful brands are built on four pillars:

- Differentiation (as established by the brand’s position and essence).

- Relevance (being personally appropriate to the individual).

- Esteem (being held in high regard).

- Knowledge (the intimate understanding of the brand and what it stands for).

Y&R argue that relevance together with differentiation produce brand strength, while esteem and knowledge combine to produce brand stature. Two things make the Y&R model worth considering. One is that a marketing program—often advertising, can enhance each of the four elements. A second is that their research suggests that most brands evolve predictably over time. Thus, a manager can evaluate the current position of his or her brand by the pattern of the four indicators, and then think about the management actions required to move it to, or keep it in, the northeast quadrant of the grid. For example, the brands that; lack differentiation are the ones most likely to start a price war.

One of the important things about this model is the idea that brand growth needs to be in this order. Strong brands start with differentiation, understanding and building how it is they are different from the competition. This approach is different from a common one in which people normally say, `Oh, we just have got to get our name out there. We just have to have knowledge. Everybody is going to know about us.’ Regarding the Super Bowl 2000, with a lot of the dot.com advertising, that is what it was about knowledge – and they forgot about differentiation and distinctiveness to their sorrow. You have to start with the differentiation, even if that means starting on a small scale. Differentiation is the driver of the brand. Without differentiation, customers are going to have no basis for selection. Manufacturers are going to have no reason to expect loyalty. Consumers are going to want to pay less if they do not know why it is that they should be paying more!

The data indicate that successful brands develop differentiation first. Then they develop relevance; then esteem; then knowledge. This is the way to develop a brand, and the order of emphasis. Without a differentiated position, brands are very likely to decline. With the differentiated position there is a reason for customers to get to know more about the brand, and a reason to build up esteem and knowledge. This is not to suggest that differentiation is the only component. Differentiation alone is not going to build a strong brand. Brand strength is based both on differentiation and relevance, how the brand is different, and why the customer cares. A strong brand also has the stature of esteem and knowledge.

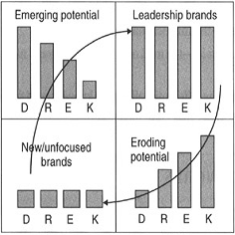

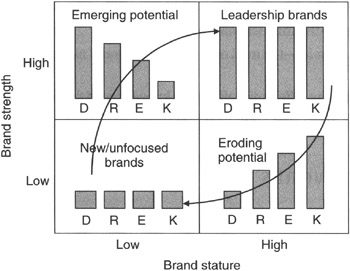

The Figure 1 shows the Y&R brand power grid. This shows brand stature across the bottom, brand strength moving up the side. There are a variety of very new or unfocused or stagnant brands in the first quadrant, where there is low brand stature and low brand strength. The brands are new and they have to work up to build the relevance and differentiation that take them into the unrealised potential or niche market quadrant. The quadrant with high brand strength, low brand stature, indicates brands with high differentiation and some degree of relevance, but with some lesser degree of knowledge and esteem. What they do at that point is critical to what happens to the brand. Some brands stay there. The niche brands stay there with high relevance to a small market segment, but low relevance to the rest of the world. However, some brands are then able to move into the leadership position. That is where there is strength on all four pillars. The leadership quadrant companies, eg Microsoft, and Nike, have high differentiation, high relevance, high esteem and high knowledge.

The final quadrant is one where we often see companies that were doing well, but allow themselves to slip, often due to societal changes that they’re not able to respond to effectively. For example, Greyhound used to be a differentiated transportation alternative. Now, it is unlikely hat many people here have actually ridden on a Greyhound. Changes made bus transportation less relevant to US consumers. In the eroding potential quadrant, companies no longer have differentiation, even though they often have high knowledge.

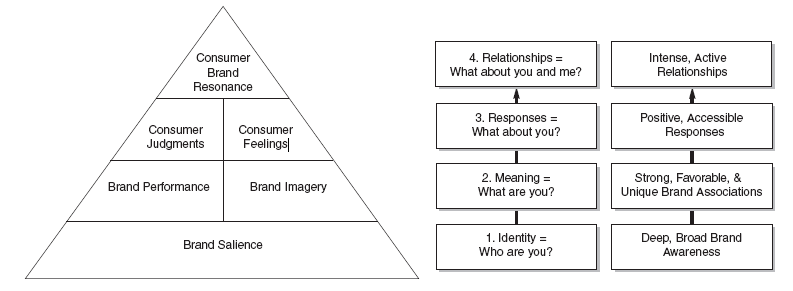

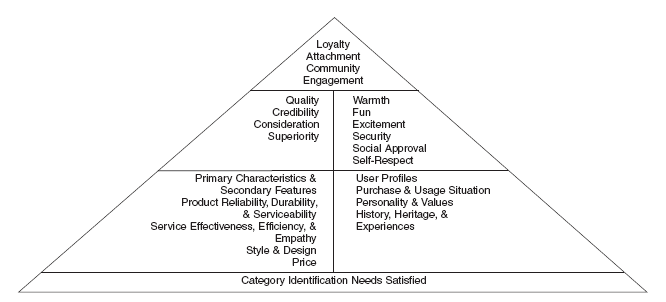

Keller’s Customer-Based Brand Equity Model (Brand resonance Model)

A strong brand can be leveraged to achieve greater market share and increased profits. The trick, though, is building the powerful brand. In order to do so, a company must begin with customer and work backwards to shape the brand to achieve the maximum impact with those customers. This process of molding a brand with customer resonance requires carefully sequenced brand-building efforts.

A comprehensive new approach, the customer-based brand equity (CBBE) model, lays out a series of four steps for building, maintaining, and monitoring a strong brand:

- Establish the proper brand identity

- Create the appropriate brand meaning

- Elicit the right brand responses

- Forge appropriate brand relationships with customers.

The CBBE model also depends on six brand-building blocks:

- Salience

- Performance

- Imagery

- Judgments

- Feelings

- Resonance

That helps provide the foundation for successful brand development.

With the CBBE model, the strongest brands excel in all six of the brand-building blocks. The most valuable building block, brand resonance, occurs when all the other brand-building blocks are completely in sync with customers’ needs, wants, and desires. Simply put, brand resonance reflects a completely harmonious relationship between customers and the brand. The strongest brands will be the ones to which those consumers become so attached that they, in effect, become evangelists and actively seek means to interact with the brand and share their experiences with others. Firms that are able to achieve resonance and affinity with their customers should reap a host of valuable benefits, such as greater price premiums and more efficient and effective marketing programs.

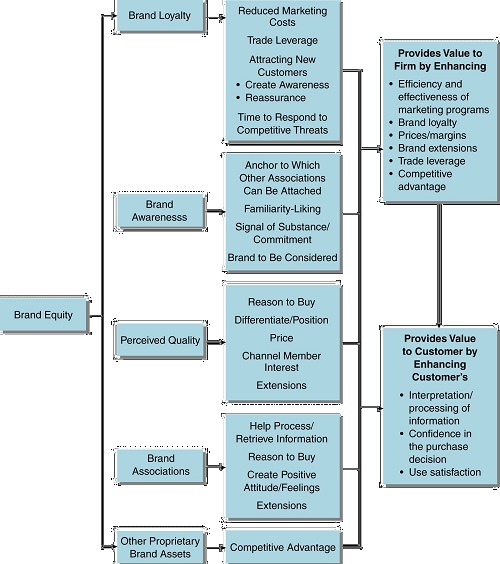

Aaker’s Brand Equity Model:

As per David Aaker Brand Equity is a set of brand assets and liabilities linked to a brand, its symbol, that adds to or subtracts from the value provided by a product or services to a firm and / or to that firms customers.

Thus as per one of the most recognized model of strategic Brand Management:

- Brand Equity is a set of assets hence management of Brand Equity involves investment to create and enhance these assets.

- Each Brand Equity assets creates value in a variety of different ways.

- Brand Equity creates value for consumer as well as firm.

- The assets and liabilities to underlie Brand Equity, it must be linked to the Brand name or other elements of Brand.

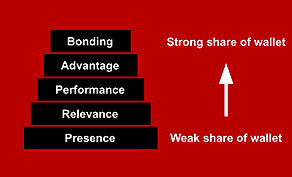

BRANDZ, The BrandDynamics Pyramid:

Marketing research consultants Millward Brown and WPP developed this particular model of brand strength. This model has Brand pyramid at the heart of it. As per this model brand building involves a serious of steps. The objective at each step in ascending order is as follows:

- Presence – Active familiarity based on past trial, saliency or knowledge of brand promise.

- Relevance – Relevant to consumer’s needs, in the right price range or in consideration set.

- Performance – Felt to deliver acceptable product performance and is on the consumer’s short-list.

- Advantage – Felt to have an emotional or rational advantage over other brands in the category.

- Bonding – Rational and emotional attachments to the brand to the exclusion of most other brands.

Research has shown that at the top level of pyramid, where a bonded consumer exists, builds a stronger relationship with the brand than those at lower levels. The challenge for marketers is to develop activities and program that help consumers move up the pyramid.

Purchasing loyalty increases at higher levels of the Pyramid – consumers at the level of Bonding are likely to be active advocates of the brand. There is also an increase in share of wallet – the proportion of consumer expenditure within the category on that brand – as you ascend the Pyramid. The goal is to build as large a group as possible of truly loyal consumers, by sustaining a suitable relationship and increasing their loyalty to the brand. For each brand, each person interviewed is assigned to one level of the pyramid depending on their responses to a set of questions. The BrandDynamics Pyramid shows the number of consumers who have reached each level.

In sustaining a relationship with the consumer and increasing loyalty, a brand will succeed in converting more individuals up the BrandDynamics Pyramid. The rate at which a brand converts people from one level to the next is calculated; by comparing this with what you would expect given the brand’s size, we can identify the strengths and weaknesses of a brand relative to other brands in its category. This method eliminates the effect of size, thus allowing you to compare the strengths of two brands regardless of whether they are small or large.

A Brand Signature might look like this: Each bar corresponds to one level of the BrandDynamics Pyramid. Red bars on the left of the line indicate that the brand converts fewer people than expected; blue bars to the right indicate the brand converts more people than expected.

Therefore, we can identify a brand with this Brand Signature as a Cult Brand. It is not widely known and not relevant to everyone – but those for whom it is relevant form a committed and fanatical following.

Measuring Brand Equity

There are many ways to measure a brand.Some measurements approaches are at the firm level, some at the product level, and still others are at the consumer level.

Firm Level: Firm level approaches measure the brand as a financial asset. In short, a calculation is made regarding how much the brand is worth as an intangible asset. For example, if you were to take the value of the firm, as derived by its market capitalization – and then subtract tangible assets and “measurable” intangible assets- the residual would be the brand equity. One high profile firm level approach is by the consulting firm Interbrand. To do its calculation, Interbrand estimates brand value on the basis of projected profits discounted to a present value. The discount rate is a subjective rate determined by Interbrand and Wall Street equity specialists and reflects the risk profile, market leadership, stability and global reach of the brand.

Product Level: The classic product level brand measurement example is to compare the price of a no-name or private label product to an “equivalent” branded product. The difference in price, assuming all things equal, is due to the brand. More recently a revenue premium approach has been advocated.

Consumer Level: This approach seeks to map the mind of the consumer to find out what associations with the brand that the consumer has. This approach seeks to measure the awareness (recall and recognition) and brand image (the overall associations that the brand has). Free association tests and projective techniques are commonly used to uncover the tangible and intangible attributes, attitudes, and intentions about a brand. Brands with high levels of awareness and strong, favorable and unique associations are high equity brands.

Any of these calculation are at best approximations. A more complete understanding of the brand can occur if multiple measures are used.

APPLICATION:

The emergence of Brand equity concept in 1980 has meant both good and bad news for marketers. Today Brand Equity has become the most popular and potentially important marketing concept.

Good News: The concept of Brand Equity has provided much needed focus in the importance of Brand in the marketing strategy. It adapts to current theorizing and research advances in new challenges in brand management and thus provides valuable insights.

Bad News: The concept of Brand Equity has various connotations resulting in confusion and frustration with the term.

Fundamentally, branding is about endowing products and services with the power of Brand Equity. That is, brand equity relates to the fact that different outcomes result from the marketing of a product or service and are directly attributable to a brand.

Strategic Brand Management:

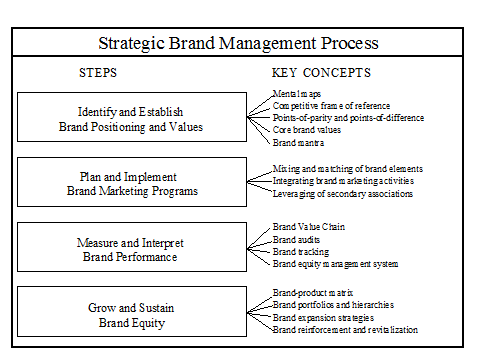

It involves the design and implementation of marketing programs and activities to build, measure, and manage brand equity. The steps in strategic Brand management process in shown in Figure 10.